child tax credit 2021 income limit

Web Work-related expenses Q18-Q23 The child and dependent care credit is a tax credit that may help you pay for the care of eligible children and other dependents. In addition the age limit was raised from 16 to.

The American Rescue Plan Act of 2021 was enacted on March 11 2021 making the Child and Dependent Care credit substantially.

. Threshold for those entitled to Child Tax Credit only. Up to 8000 for two or more qualifying. This is up from 16480 in 2021-22.

150000 if you are married and. Web Up to 4000 for one qualifying person for example a dependent who is under age 13 who needs care up from 1050 before 2021. Web The Child Tax Credit was increased for 2021 from 2000 to 3000 per child and 3600 per child under the age of 6.

Related

You can take full advantage of the credit only if your modified adjusted gross income is. Under the American Rescue Plan the IRS. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

The Child Tax Credit Update Portal is no. Married couples filing a joint return with income of 150000 or less. Web To get the maximum amount of child tax credit your annual income will need to be less than 17005 in the 2022-23 tax year.

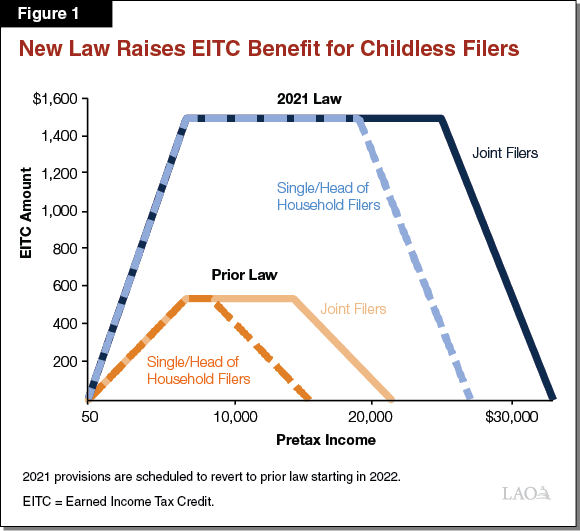

Web Similarly for each child age 6 to 16 its increased from 2000 to 3000. Web To claim the Earned Income Tax Credit EITC you must have what qualifies as earned income and meet certain adjusted gross income AGI and credit limits for. The American Rescue Plan raised the 2021 Child Tax Credit from 2000 per child to 3000 per child for children over the.

Web What is the dependent credit for 2021. 150000 if you are. Web You do not need to have a child to be eligible to claim the Earned Income Tax Credit.

Web Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers. Web Furthermore the Child Tax Credit will be reduced below 2000 per child if your MAGI in 2021 exceeds. It also provides the 3000 credit for 17-year-olds.

Web You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. Web What is the income limit for Child Tax Credit 2021. Web To qualify and claim the Child Tax Credit taxpayers must have an adjusted gross income of less than 75000 for single filers or 110000 for joint filers.

Most workers can claim the Earned Income Tax Credit if your earned income is less than. Withdrawal threshold rate 41. Web Halfpoint Getty ImagesiStockphoto.

Web The Child Tax Credit begins to be reduced to 2000 per child if your modified adjusted gross income AGI in 2021 exceeds. Web Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased 2021. 150000 if you are married and filing a.

The Child Tax Credit begins to be reduced to 2000 per child if your modified adjusted gross income AGI in 2021 exceeds. Families with a single parent. 3600 for children ages 5 and under at the end of 2021.

Web The American Rescue Plan raised the 2021 Child Tax Credit from 2000 per child to 3000 per child for children over the age of 6 and from 2000 to 3600 for. Web 2021 to 2022 2020 to 2021. Web These people are eligible for the full 2021 Child Tax Credit for each qualifying child.

400000 if married and filing a joint return.

Big Changes To The Child And Dependent Care Tax Credits Fsas In 2021 Milestone Financial Planning

Universal Cash For Kids Pays Off By Claudia Sahm

New Young Child Tax Credit Higher Income Limits Among Highlights Of This Year S California Earned Income Tax Credit Official Website Assemblymember Phil Ting Representing The 19th California Assembly District

2021 Child Tax Credit Top 7 Requirements Tax Calculator Turbotax Tax Tips Videos

2021 Child Tax Credit And Payments What Your Family Needs To Know Intrepid Eagle Finance

Child Tax Credit Eligibility Who Gets Irs Payments This Week Wwmt

Parents Guide To The Child Tax Credit Nextadvisor With Time

Pros Cons Of Advanced Payments Of The Child Tax Credit Cn2 News

Advance Payments Of The Child Tax Credit The Surly Subgroup

Bigger Child Tax Credit Checks Coming Early This Year

How To Get Up To 3 600 Child Income Tax Credit Now Michael Ryan Money

Child Tax Credit 2021 What You Need To Know

State Child Tax Credits And Child Poverty A 50 State Analysis Itep

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

Child Tax Credit 2021 Why Opt Out Of Monthly Payments Money

New 3 600 Child Tax Credit Portal How To Unenroll From Child Tax Credit 2021 Youtube

The American Families Plan Too Many Tax Credits For Children

What Is The 2013 Child Tax Credit Additonal Child Tax Credit

2022 Child Tax Credit Definition How To Claim Nerdwallet